ev tax credit bill text

Under the bill individual taxpayers reporting adjusted gross incomes of 250000 or 500000 for joint filers to get the new EV tax credit. The policy also set a cap.

/https://www.forbes.com/wheels/wp-content/uploads/2021/10/TopEVResistanceReasons.png)

Survey 23 Of Americans Would Consider Ev As Next Car Forbes Wheels

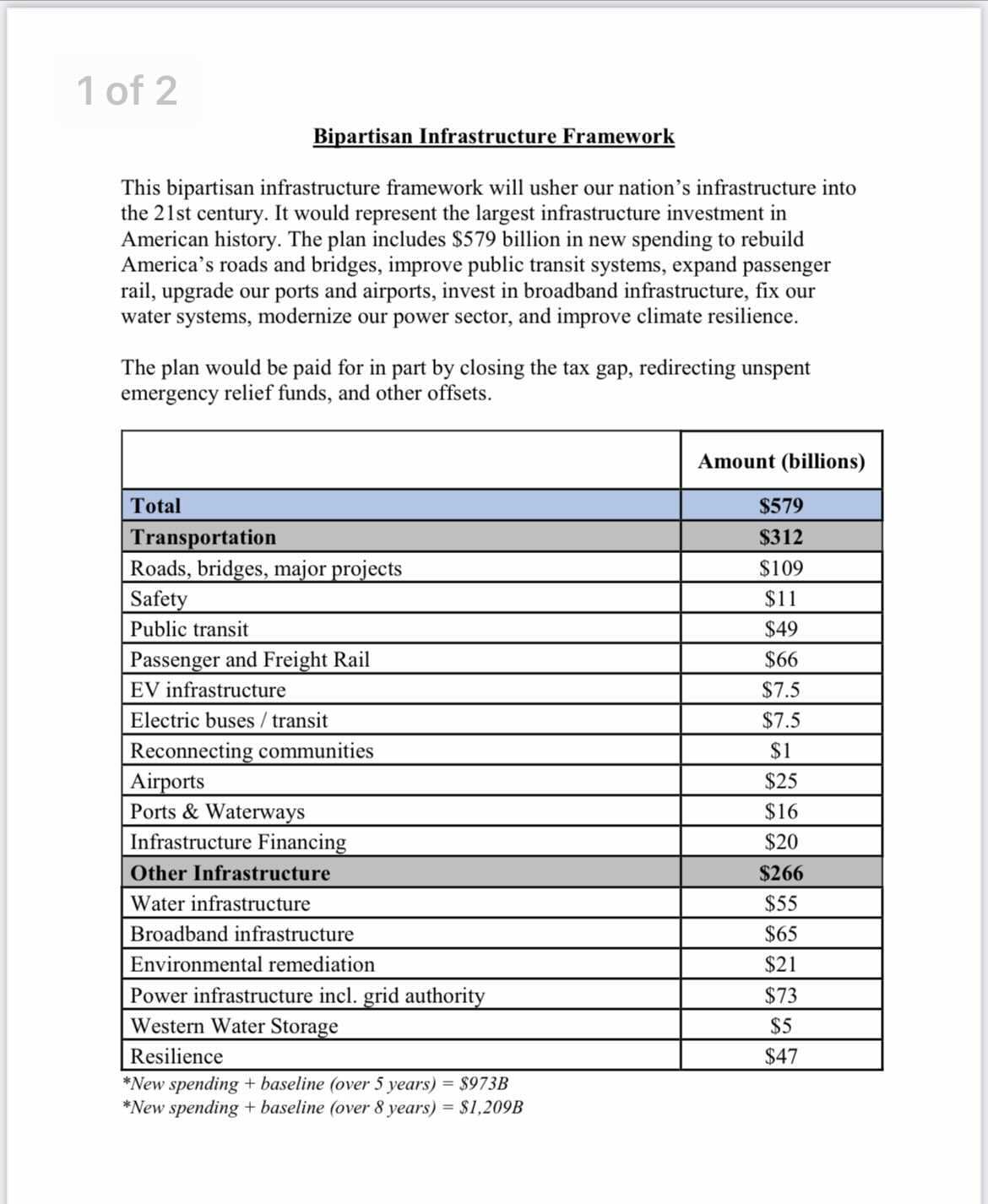

On Thursday the White House announced dollar figures and.

. The full EV tax credit will be available to. The policy allows taxpayers to get credits of up to 7500 for the purchase of electric-powered vehicles provided individuals owed at least that much in taxes that year. Preliminary Senate Finance Committee text for the social spending and climate bill released over the weekend retains a tax credit for union-made electric vehicles despite objections to the provision by Sen.

Joe Manchin D-WVaThe preliminary text released by Chairman Ron Wyden D-Ore includes a 4500 credit for electric vehicles domestically produced in. Changes include raising the federal EV tax rebate ceiling to 12500 and opening the door for automakers who already exhausted their production quotas. The Build Back Better bill includes a 12500 EV tax credit up from the current 7500 available to qualifying cars and buyers.

This Act may be cited as the Electric Bicycle Incentive Kickstart for the Environment Act or as the E-BIKE Act. All-electric and plug-in hybrid cars purchased new in or after 2010 may be eligible for a federal income tax credit of up to 7500. President Bidens Build Back Better bill would increase the electric car tax credit from 7500 to 12500 for qualifying vehicles however this bill has only passed and not the Senate as of April 2022.

Credit for certain new electric bicycles. 0 seconds of 1 minute 4 secondsVolume 0. A In general Subpart C of part IV of subchapter A of chapter 1 of the Internal Revenue Code of 1986 is amended by adding at the end the following new section.

What truly stands out in this approved bill is the 75 billion promised to help establish a nationwide network of EV charging stations. The Clean Energy for America bill which advanced on a 14-14 tie vote would eliminate the existing EV cap while the credit would phase-out over three years once 50 of US. The tax credit is also.

On Tuesday Sept. State andor local incentives may also apply. The amount of the credit will vary depending on the capacity of the battery used to power the car.

The US Senate Finance Committee has put forth a bill to extend and strongly improve the US federal EV tax credit. On Wednesday the Senate Finance Committee advanced the Clean Energy for America Act making a few tweaks from earlier proposals. Sales of 2022 of Electric Vehicles continues go grow.

There is a federal tax credit of up to 7500 available for most electric cars in 2022. President Joe Bidens Build Back Better framework a combination of social spending projects that were part of his. 2 2- AND 3-WHEELED PLUG-IN ELECTRIC VEHICLESSubparagraph E of section.

Under the bill the expanded tax credit is available to taxpayers with an adjusted gross income cap of up to 250000 for individuals and. The US Senate has voted to approve a non-binding resolution setting a 40000 threshold on the price of electric cars that would be eligible for a 7500 federal tax credit. CHARLESTON While the 175 trillion Build Back Better social spending bill has changed nearly daily for the last several weeks a provision that could put electric vehicle manufacturers in West Virginia at a disadvantage has remained unchanged.

State and municipal tax breaks may also be available. It also would limit. The bill says individual taxpayers must have an adjusted gross income of no more than 400000 to get the new EV tax credit.

A Extension 1 I N GENERALSubsection e of section 30D of the Internal Revenue Code of 1986 is amended to read as follows. The credit amount will vary based on the capacity of the battery used to power the vehicle. 14 the House Ways and Means Committee debated electric vehicle EV tax credits as part of the budget reconciliation bill and those provisions will be voted on today.

Several months later it seems that revisions to the credit are returning to lawmaker agendas. Briefly lets look at a. If you purchased a Nissan Leaf and your tax bill was 5000 that.

However the measure. It would limit the EV credit to. The new electric vehicle tax credit would be 12500 and refundable.

In 2021 United States electric vehicle sales grew to over 430000 increasing from 2020. The nearly 2 trillion in spending includes a much-talked-about boost for the electric vehicle tax credit from 7500 to 12500. Small neighborhood electric vehicles do not qualify for this credit but.

The exceptions are Tesla and General Motors whose tax credits have been phased out. All-electric and plug-in hybrid vehicles bought new in or after 2010 may be eligible for a 7500 federal income tax credit. We will continue to work.

E TerminationThis section shall not apply to any new qualified plug-in electric drive motor vehicle placed in service after December 31 2031. The 185 trillion budget bill that will also be the largest climate. NADA supports tax credits to incentivize the purchase of EVs but cannot support the bill in its current form.

The bill says individual taxpayers must have an adjusted gross income of no more than 400000 to get the new EV tax credit. After the failure of the Build Back Better bill in late 2021 the existing proposals for the expansion of the EV tax credit were abandonedThe EV tax credit remains at 7500 for all electric models except those made by Tesla and General Motors. Updated April 2022.

Preliminary Senate Finance Committee text for the social spending and climate bill released over the weekend retains a tax credit for union-made electric vehicles despite objections to.

Latest On Tesla Ev Tax Credit March 2022

Electric Vehicle Tax Credits Rebates Snohomish County Pud

Anaheim Public Utilities Incentives

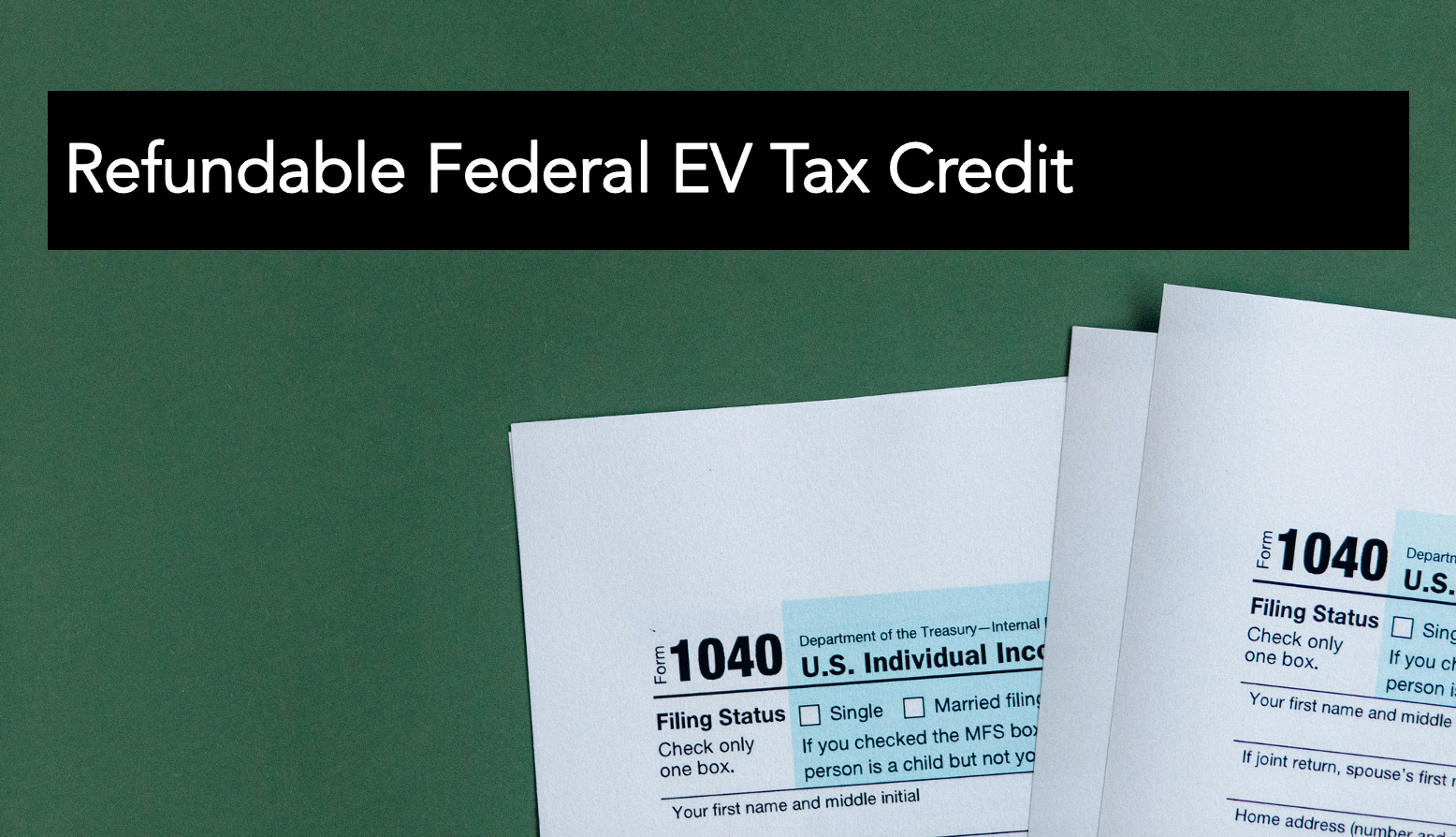

Proposed Changes To Federal Ev Tax Credit Part 5 Making The Credit Refundable Evadoption

Oil Industry Cons About The Ev Tax Credit Nrdc

Will Tesla Gm And Nissan Get A Second Shot At Ev Tax Credits Extremetech

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek

Electric Car Electric Bill Off 70

Proposed Changes To Federal Ev Tax Credit Part 5 Making The Credit Refundable Evadoption

Oil Industry Cons About The Ev Tax Credit Nrdc

How To Calculate The Federal Tax Credit For Electric Cars Greencars

Mce Rebates For Your Electric Vehicle

Oil Industry Cons About The Ev Tax Credit Nrdc

Latest On Tesla Ev Tax Credit March 2022

How Electric Vehicle Tax Credits Work

Maryland Ev Tax Credit Status As Of June 2020 Pluginsites

Electric Car Electric Bill Off 70

How To Calculate The Federal Tax Credit For Electric Cars Greencars